uzfhelen706240

About uzfhelen706240

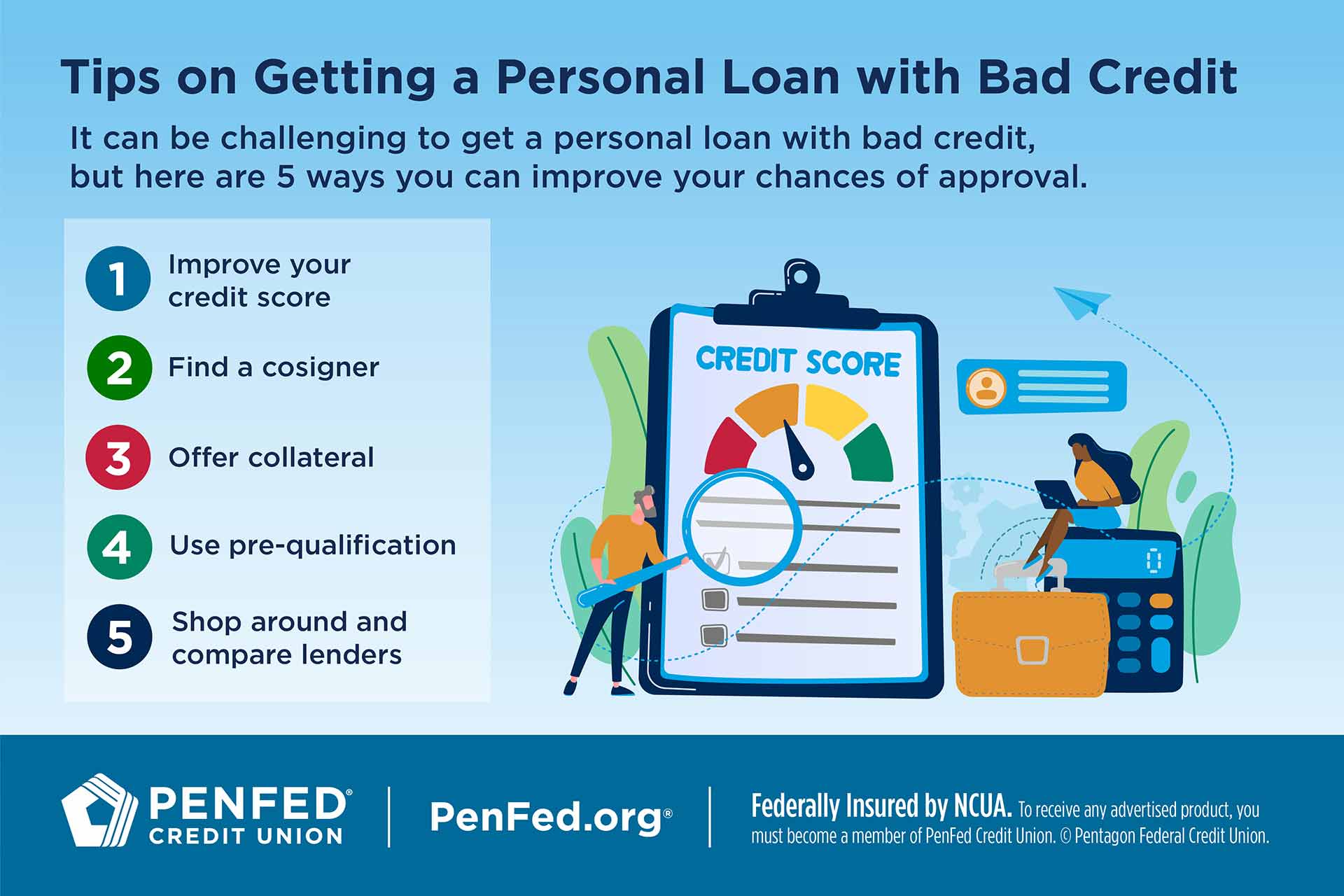

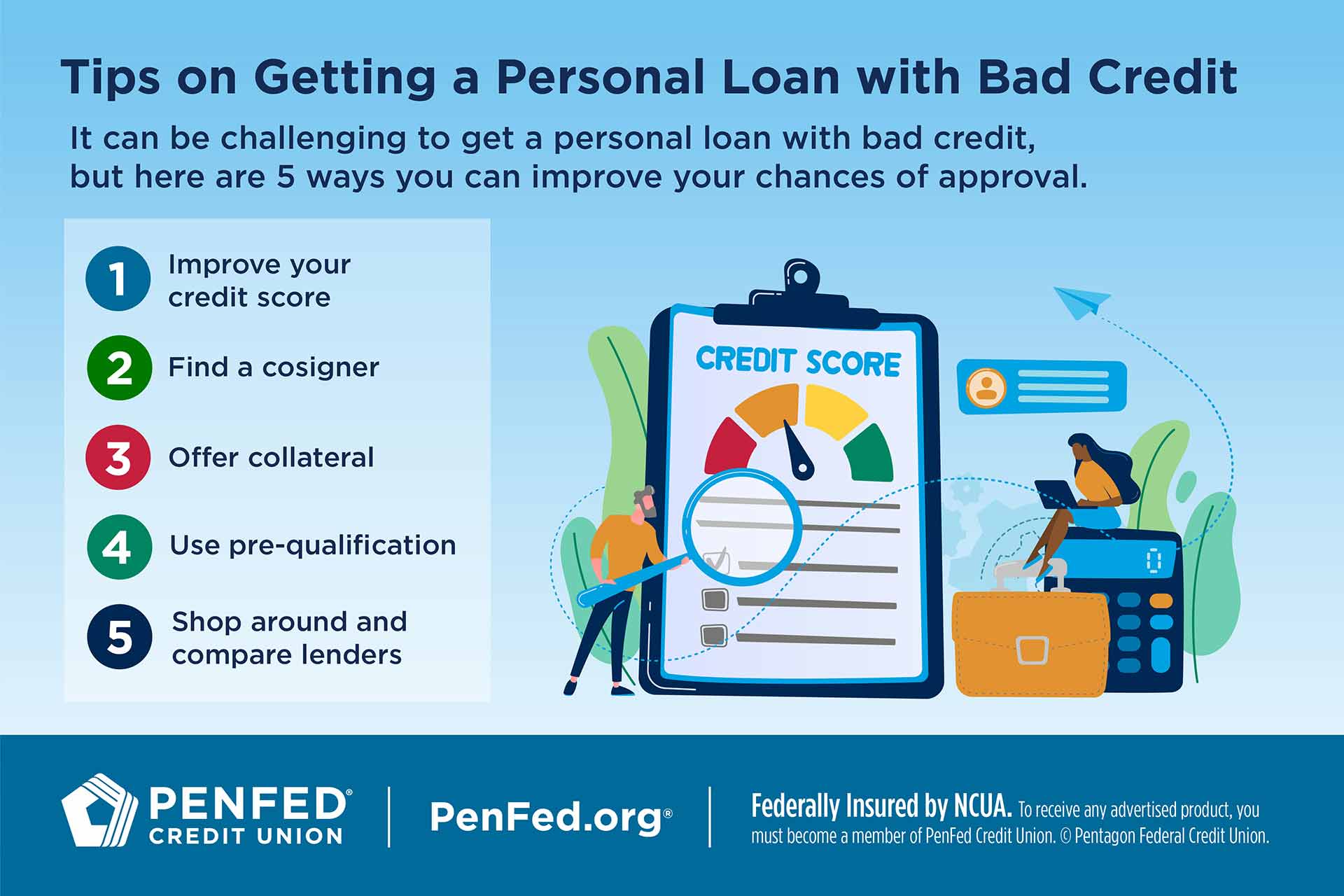

Understanding Personal Loans for People with Bad Credit Score Rankings

In right now’s financial panorama, personal loans have grow to be a well-liked option for individuals looking for fast access to funds for various functions, similar to consolidating debt, financing a big buy, or protecting unexpected expenses. Nonetheless, for those with bad credit scores, the journey to securing a personal loan could be fraught with challenges. This article delves into the intricacies of personal loans for people with bad credit score, exploring the causes of bad credit score, the implications for loan approval, and potential options for borrowers in this predicament.

Understanding Dangerous Credit score Ratings

A credit score score is a numerical illustration of an individual’s creditworthiness, derived from their credit score historical past. Elements influencing credit ratings embody payment historical past, credit utilization, size of credit history, sorts of credit score accounts, and recent credit inquiries. A nasty credit rating usually falls under 580 on the FICO scale, which ranges from 300 to 850. Widespread causes for poor credit scores embody missed funds, excessive credit score utilization, bankruptcies, and foreclosures. These elements not only affect the ability to secure loans but can also result in greater curiosity rates and less favorable loan phrases.

The Impression of Unhealthy Credit on Loan Approval

When applying for personal loans, lenders assess borrowers’ creditworthiness primarily via their credit scores. For individuals with dangerous credit, this could pose vital boundaries. Many traditional lenders, together with banks and credit unions, have strict lending criteria that often exclude candidates with poor credit score histories. These establishments could view people with bad credit as high-danger borrowers, resulting in automatic denials or exorbitant curiosity rates.

However, the rise of alternative lending choices has supplied some relief for those with dangerous credit. On-line lenders, peer-to-peer lending platforms, and credit unions may offer more lenient terms and are sometimes keen to think about elements beyond credit scores, akin to income, employment stability, and overall financial habits. While these options could also be extra accessible, they typically come with larger interest charges and charges, reflecting the increased risk lenders assume.

Exploring Loan Choices for Unhealthy Credit score

- Secured Personal Loans: A technique to increase the possibilities of loan approval is by choosing a secured personal loan. This sort of loan requires the borrower to provide collateral, reminiscent of a automobile or financial savings account, which the lender can declare if the borrower defaults. Secured loans sometimes have lower curiosity charges in comparison with unsecured loans, making them a viable possibility for these with dangerous credit. Nonetheless, borrowers have to be cautious, as failing to repay the loan could end result in the loss of the collateral.

- Credit Union Loans: Credit score unions are nonprofit organizations that always provide extra favorable lending terms than traditional banks. They might provide personal loans particularly designed for people with unhealthy credit. Since credit unions are member-centered, they might take a extra holistic strategy to lending, contemplating factors akin to group ties and overall financial conduct reasonably than solely relying on credit score scores.

- Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms connect borrowers with individual traders willing to fund their loans. These platforms typically have extra flexible lending criteria and may be extra inclined to work with borrowers who have unhealthy credit score. However, curiosity charges can differ extensively based on the perceived threat, so borrowers ought to rigorously evaluation the terms earlier than proceeding.

- Payday Loans: While payday loans are easily accessible for individuals with bad credit score, they are often not advisable resulting from their exorbitant interest rates and short repayment terms. Borrowers can shortly discover themselves trapped in a cycle of debt, making it troublesome to flee the financial burden. It is essential to discover other choices earlier than resorting to payday loans.

- Co-signer Loans: If potential, individuals with bad credit can consider having a co-signer with good credit score apply for the loan on their behalf. A co-signer agrees to take responsibility for the loan if the primary borrower defaults, which can enhance the possibilities of approval and secure better curiosity rates. Nevertheless, this feature requires a high stage of trust and communication between each events, as the co-signer’s credit is in danger if the borrower fails to make funds.

Bettering Credit score Rankings

Whereas securing a personal loan with bad credit is possible, it is also important for borrowers to take proactive steps to enhance their credit score scores over time. If you have any kind of questions relating to where and how you can use personalloans-badcredit.com, you can contact us at our own web page. Listed here are some methods to contemplate:

- Pay Payments on Time: Timely funds on current debts and bills can regularly enhance credit scores. Setting up computerized funds or reminders might help be certain that payments are made promptly.

- Cut back Debt: Paying down existing debts, notably excessive-curiosity credit card balances, can enhance credit score utilization ratios and positively affect credit score scores. Making a budget to manage spending and allocate funds toward debt repayment is crucial.

- Examine Credit Studies: Often reviewing credit score stories might help people identify errors or inaccuracies that may be negatively affecting their scores. Disputing any discrepancies with credit score bureaus can lead to corrections and enhancements in credit score scores.

- Restrict New Credit score Functions: Every credit inquiry can barely decrease credit scores, so it is wise to limit new credit score applications. As an alternative, deal with enhancing existing credit accounts and managing debt responsibly.

Conclusion

Securing personal loans with dangerous credit score scores could be difficult, but it’s not not possible. By understanding the elements that affect credit score scores and exploring various lending options, people can discover solutions that meet their financial wants. Additionally, taking proactive steps to improve credit rankings can lead to better borrowing alternatives in the future. Because the financial panorama continues to evolve, individuals with dangerous credit score ought to remain knowledgeable and empowered to make one of the best choices for their monetary nicely-being.

No listing found.